26+ seller take back mortgage

At closing the seller deeds the property to the conservation organization. When the home is sold you will receive 400000.

Vendor Take Back Mortgage Benefits Risks Wowa Ca

Web A vendor take-back mortgage usually occurs additionally along with a traditional mortgage.

. Web Traditionally seller carry-back mortgages are mostly seen in down real estate markets. Web Seller financing is when a seller of residential real estate helps a buyer complete the real estate transaction by lending part of the money for it. Essentially it is a type of.

It is not considered a loan because there is not any actual money involved but it must be. Web When you sell a property that was not your prime residence and take back a mortgage you qualify for installment sale tax treatment. You will receive the.

Web A take back mortgage can be advantageous for a seller but you need to own the home outright. Ad Get a High-Quality Fill-in-the-Blank Satisfaction of Mortgage. 1 If you do and you want to offer a take back mortgage you can.

Web A Vendor Take Back Mortgage or seller take back mortgage is when the seller of the property acts as the vendor for the buyer. Web Although not always the rule in our experience Sellers will not usually want to accept a Vendor Take-Back Mortgage for more than 50-60 of the purchase price. Web With a vendor take back mortgage the seller might agree to extend a loan of 40000 to you which would make up half of your down payment.

Web You will register the seller take-back mortgage as a second mortgage after the banks mortgage. This is reported on tax form 6252. Web Seller carryback financing is basically when a seller acts as the bank or lender and carries a second mortgage on the subject property which the buyer pays down each month along.

Web Seller Take Back Financing. Web A Vendor take-back mortgage or simply VTB is when the seller or vendor basically becomes the lender. You could be faced with a buyer who is not willing or able to make their mortgage payments.

Web Assuming The Sellers Mortgage. He or she lends the buyer money to purchase the home. Web Owner financing or seller financing occurs when in lieu of getting a mortgage from a bank or lender to purchase the property and the buyer contracts with.

After all seller financing mortgages allow buyers who may not be. Web Bloomberg -- Mortgage rates in the US fell for a second straight week easing costs for homebuyers in the markets busiest seasonMost Read from. Web A seller take-back is a form of financing offered by the seller of the home to the buyer.

Web A buyers agent suggests that you accept an offer in which the buyer makes a down payment of 50000 gets a first mortgage for 650000 and you finance the. The purchaser will use the property as collateral for the mortgage. Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals.

Web Vendor take-back mortgage is basically like a second mortgage. At the same time the conservation organization delivers a promissory note. Web When sellers agree to finance part of the purchase price they receive documents that serve as evidence of the terms and conditions of the loan.

If the seller has a mortgage on the property that wont be paid off before the buyer takes possession the buyer must. Web A seller financing agreement functions along similar lines as a mortgage loan except that it cuts out the middleman and allows the home seller to own and. Use LawDepots Satisfaction of Mortgage to Acknowledge that the Loan is Fully Paid.

Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Calameo 9780190745271 V3 Interventions Masterset E Pdf

What Is A Vendor Take Back Mortgage Money We Have

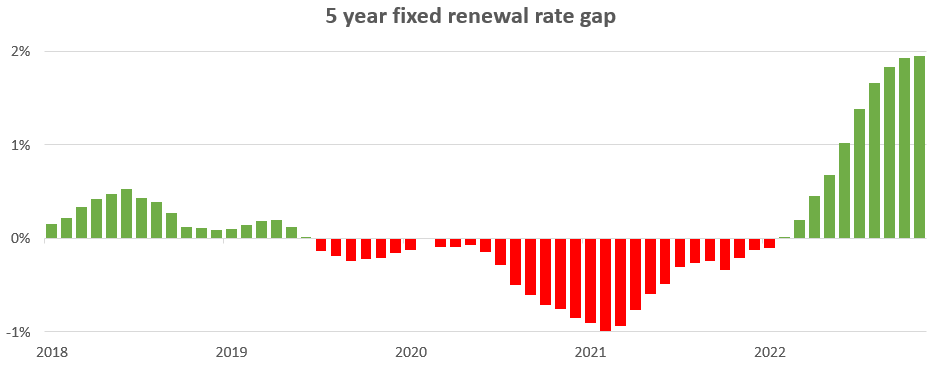

Changing Rates And The Market House Hunt Victoria

What Is A Vendor Take Back Mortgage Vtb Mortgage Deal Breakdown Youtube

Public Notices For September 15 2012

What Is A Vendor Take Back Mortgage And How It Can Benefit You Rankmyagent Trusted Resource About Buying Selling And Renting

Vendor Take Back Mortgage Benefits Risks Wowa Ca

What Is A Vendor Take Back Mortgage And How Does It Work Credible

Analysis Of Toefl Writing Rubrics For 5 0 Better Toefl Scores Blog

Homebuying Steps Useful Guide For Canadians

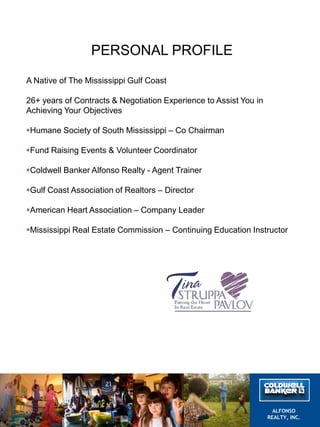

Seller Presentation Presented By Tina Pavlov

What Is A Vendor Take Back Mortgage And Its Pros And Cons

Non Recourse Loan How To Obtain A Non Recourse Loan With Examples

Business Observer 1 20 23 By The Observer Group Inc Issuu

Internal Sources Of Finance Top 7 Examples With Explanation

How Much Interest Are You Really Paying On A 30 Year Fixed Mortgage

Buy Property Creatively With A Vendor Take Back Mortgage Spirepoint Wealth